Sound Solutions to Common Problems

Account Xpress

Personal Finance Manager

List of Features

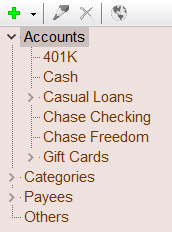

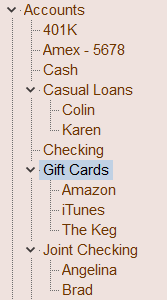

The tree view navigator in Account Xpress is an extremely useful feature that can't be found in most personal finance software products. It is both very powerful and simple to use at the same time. It provides a structural view of all your major financial elements (accounts, sub-accounts, category groups, categories, payees and others).

Thanks to the tree view navigator, access to your financial information is never more than a few clicks away in Account Xpress. But the tree view is more than a simple navigation tool. It also provides some very natural and intuitive ways to organize your category groups and categories. For example, it allows you to move categories from one group to another with simple drag-and-drop operations.

Simple Drag-and-Drop OperationsIn addition to drag-and-drop operations that allow you to organize your category groups and categories as explained above, transaction items can also be moved from their current account, category or payee to another in the same way.

Split Transactions

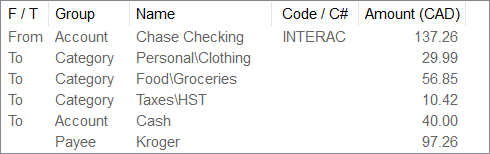

Account Xpress supports transactions that can be split between many accounts, categories and / or payees. Most personal finance software products support split transactions, however many are limited to splitting amounts between categories or accounts, but not both in the same transaction. Consider the following example:

You buy some clothes and groceries at your favorite supermarket that you pay together using your debit card. Of course, when you enter this transaction into your personal finance software, you want to split the expense amount between your Clothing and Groceries categories, but what happens if you also requested some cash back when you paid for this transaction using your debit card?

This transaction would actually combine what would normally be two different kinds of transactions (i.e. expense and transfer). While many other personal finance software would require you to enter two separate transactions to accomplish this, Account Xpress allows you to do it in a single split transaction.

Transaction Schedules

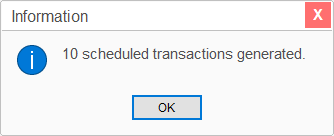

Many transactions such as car payments, rent or mortgage payments, insurance premiums payments, and many others are very repetitive in nature. With the exception of their respective occurrence dates, these transactions hardly ever change. Most details of these transactions are essentially the same from one occurrence to the next. Since the occurrence date of these transactions can easily be calculated, why should anyone ever have to enter them manually. This of course would be a real waste of time. Fortunately, thanks to transaction generators, you won't have to do so in Account Xpress.

Transaction Templates

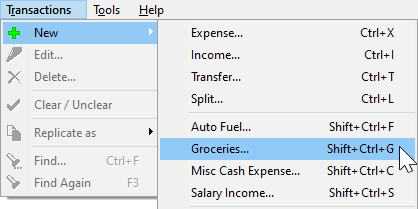

Not all repetitive transactions are good candidates for transaction schedules. Let's take grocery shopping for example. Although many of the details of these transactions are often repeated from one occurrence to the next, the amount and frequency of these transactions is not consistent enough for them to be automatically created by transaction schedules leaving you no choice but to enter them manually instead.

Fortunately, transaction templates simplify the process of entering these repetitive transactions by entering all the repetitive details automatically with a couple of clicks of the mouse or the pressing of a shortcut key, leaving you with the only task of entering the non-repetitive details such as the transaction amount and / or the transaction date.

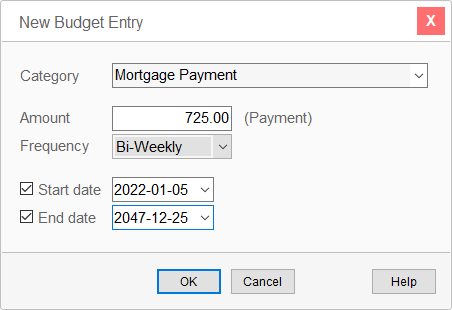

Budget Planning

Create a budget plan with the help of budget entries. Each budget entry can optionally have its own start date and / or end date. Those budget entries are then used to calculate your entire budget for any monthly based period of your choice and can be compared to your actual payments for the same period through the Budget vs Actual list or report.

Budget planning can be simplified with a 3-step process...

- Create a budget plan;

- Use the Budget vs Actual list to compare your plan with your actual payments;

- Adjust your budget plan and / or spending practices as needed to meet your financial goals.

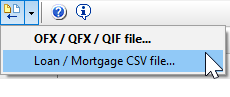

Account Xpress can import transactions from Quicken Interchange files (qif) and Open Financial Exchange files (ofx and qfx). It can also import loan and mortgage amortization data from CSV (Comma Separated Value) files.

Export to QIFAccount transactions can be exported to a QIF (Quicken Interchange File), one account per file at a time.

Copy List Selection to ClipboardYou can also copy the entries from about any list in the program to the clipboard for pasting into other software such as Word or Excel.

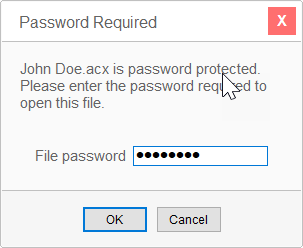

Password Protection

Account Xpress files can be password protected and encrypted with a 128-bit Advanced Encryption Standard (AES) to protect the confidentiality of your personal information. The kind of encryption adopted by the US Government.

Support for Multiple Currencies

Account Xpress supports 150 different currencies. Currency exchange rates can be downloaded directly from the Internet.

Each account in Account Xpress can be split into a number of sub-accounts for various reasons. For example, you could have a joint account and see how each owner of the account contributes (withdraws and deposits) to it individually. Or you could have a credit card account that is shared among several family members and have each family member responsible for their own (respective) spending.

Sub-accounts are also useful to keep track of casual loans that you may have with friends and relatives, as well as keeping track of the balance on your gift cards.

Business FinancesThe fact that Account Xpress is a personal finance software doesn't mean that it can not help you with your business finances in any way. First of all, what Account Xpress can do for you, it can do for some small businesses just as well. But it gets even better.

What if some of your personal finances were actually business related? Whether you operate a home office, use your own equipment (like your car) to perform your job duties, or have any other business expenses that you pay from your own pocket and need to claim back from your employer or declare as deductions on your income taxes, Account Xpress has the solution.

Categories in Account Xpress have a property called Business Ratio. The business ratio of a category can be set to anything from 0% (not business related at all, the default) to 100% (completely business related). Account Xpress then uses these ratios to produce business related financial reports for all the categories having a business ratio greater than 0%.

So if for example 25% of your rent should be counted as a business expense, then all you have to do is set the business ratio of your rent category to 25% and Account Xpress takes care of the rest. It's that simple.

Lists and ReportsAccount Xpress has a lot to offer in terms of lists that display your personal finances information on screen in just about every way imaginable. But for those who also like to see this information on paper, Account Xpress also includes many professionally designed reports.

ChartsIf it's true that a picture is worth a thousand words, then the charts in Account Xpress must have a lot to say about your personal finances. Account Xpress has many charts to show you how your net worth changes over time, how you earn and spend your money, and much more.

File BackupsWe should all be aware of the importance of taking backup copies of all our important files. But what if you do not have a file backup system in place? Then you can at least count on Account Xpress to take regular backup copies of your financial data files with its simple-to-use file backup schedule option.

Set the location and frequency at which you want Account Xpress to take a backup copy of your files and four generations of backup copies will be kept automatically for each of them.

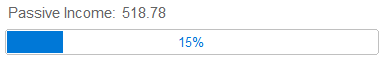

Financial Freedom Meter

Financial freedom is generally described as earning enough passive income to cover for all your regular payments and expenses while maintaining an acceptable lifestyle. Passive income is simply a regular income that one earns without having to actively work for. For example, pension income, dividends, interest on investments, etc.

Account Xpress uses categories of the passive income type to calculate how close (or far) you are from reaching financial freedom. The result is then displayed as a percentage on the financial freedom meter in Account Xpress, which can vary according to the currently selected period.

For example, if your financial freedom meter indicates 15%, then you can assume that your passive income is enough to cover 15% of your regular payments and expenses in the period currently selected. Financial freedom is achieved when the financial freedom meter indicates 100% over a significant period (i.e. many months to a year, or more).